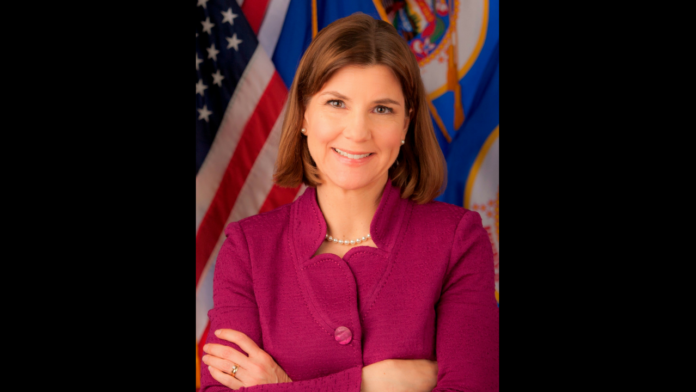

ST. PAUL, Minn. – Minnesota Attorney General Lori Swanson filed suit against two companies which gave military veterans and senior citizens small loans in exchange for large portions of their future pension earnings.

The loans most commonly had annual percentage rates (APRs) of 200 percent, gutting the pensions of borrowers for periods of up to 10 years.

“These companies had veterans and seniors sign over significant portions of their monthly pensions and benefits for years to come in exchange for much smaller immediate cash payments to cover basic living costs, medical bills, and household emergencies,” Swanson said in a press release.

The legal issue arises with two companies, Future Income Payments, LLC of Delaware and FIP, LLC of Nevada. In Minnesota, companies must be licensed as a lender in order to issue loans to borrowers in Minnesota. Swanson’s lawsuit alleges that the companies were not licensed as lenders, and that they sought to evade the law by falsely characterizing the transaction as “purchase agreements” of a pension.

Federal law also prohibits a company from acquiring the right to a veteran’s military benefits or pension. However, veterans are allowed to use their benefits or pension to help repay a loan, as long as the payment is made via a preauthorized electronic fund transfer. This means Future Income Payments and FIP characterized their products as loans to evade federal laws, and as purchases in order to evade state laws.

Colorado, California, Massachusetts, North Carolina, New York, Washington, Iowa, and Pennsylvania have all also taken action against one or both companies targeted in the lawsuit at some point in the last two years.

“A pension is supposed to provide financial security, and people should be very cautious about giving away their future pension benefits to get just pennies on the dollar in immediate cash,” Swanson said in the press release. “Borrowers’ finances can become even tighter down the road if they relinquish their future monthly pension payments.”

Swanson’s office is inviting anyone with a complaint on this issue to contact her office. The attorney general’s office can be reached by phone at (651) 296-3353 or (800) 657-3787 or via email at Nggbearl.Trareny@nt.fgngr.za.hf.