ST. PAUL, Minn.- A for-profit college came under fire recently from the Minnesota Supreme Court for administering illegal student loans.

Globe University and Minnesota School of Business issued student loans that had interest rates that were illegally high. According to the court ruling, the school was charging an interest rate of 18 percent on some of the student loans. The state law caps such loans at eight percent.

However, the school could theoretically charge 18 percent as the loans were done as a “consumer credit sale pursuant to open end credit plan.” The court found the school’s loans did not meet the necessary criteria of revolving credit (funds available to students at certain points) in order to be defined as an open end credit plan. This means that the act of charging 18 percent by the school were in fact illegal.

At the same time, the school issued the loans without proper licensing. The school argued they were not in the business of making loans, though they sometimes gave out loans that were above an eight percent interest rate. Due to the fact they were giving out loans at a rate higher than eight percent, the court found it was necessary they receive a license.

With the outcome of the case, it remains doubtful the school will be able to restart the schools in Minnesota. Minnesota state law requires the higher education commissioner strip these schools of their operational authorization if they have been found to have committed fraud. A Hennepin County court previously found that the school misrepresented students’ ability to transfer credits as it fraudulently marketed and recruited students for their criminal justice programs.

In December, the Department of Education stopped giving federal student aid dollars to the school.

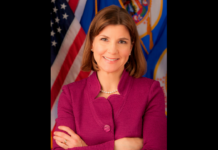

In an interview with the Pioneer Press, Attorney General Lori Swanson said, “The reality is there are problems with (Globe University and the Minnesota School of Business) and there are problems with the for-profit college industry.”