The liberals, Fake News and Co. for the last several weeks have driven widespread leftist propaganda with the misleading narrative that the Republicans’ Tax Reform plan, specifically, cuts to Corporate tax rates, only makes ‘the rich richer’ and benefits the wealthy. Nothing could be further from the truth, it is fear mongering at it’s best. Saul Alinsky would be proud.

The liberals have greatly misled public perception of the historic bill, some polls showing nearly two-thirds of people believing its benefits will affect corporations, the wealthy, and CEOs. A common misconception is that CEOs are owners of companies – they are only employees, albeit highly paid ones.

It’s true that one of the big highlights of this historic tax bill is to cut the corporate tax rate to 21% from 35%. That will, no doubt, stimulate the U.S. economy as soon as next year. In fact, in just the anticipation of this tax bill, the S&P 500 has had a historic year, increasing the value of the stock by 20%.

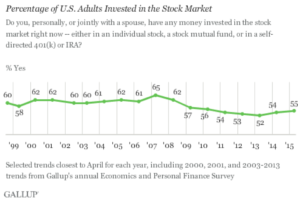

The liberals cannot deny that fact. However, they say the stock market just benefits the rich.

Let’s start with some quick facts:

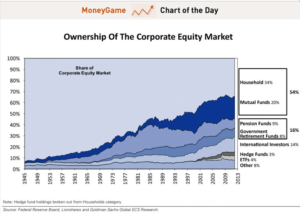

Hedge funds (the ultra-wealthy) only own about 3% of common stock leaving the remaining amount to be owned by mutual funds and get ready for this: pension and retirement funds own the majority of mutual funds.

The effects of this sweeping tax reform are expected to be felt within the markets as soon as early next year – lowering the corporate tax rate can only project and signal higher growth and a better outlook for companies raising the stock prices.

With pensions well underfunded and social security in trouble; one invested in the markets can only benefit from such corporate tax cuts; most simply, when it comes to retirement plans and safety, the average person will benefit.

In the meantime, the $1.5 trillion tax cut is expected to affect households across America, with at least 48% of households to receive a tax cut greater than $500 (according to the nonpartisan Joint Committee on Taxation).

More prosperous retirements in the future.

Bigger paychecks today.

Why would anyone want to demonize such benefits to the American people?

Peak liberalism was reached when leftists did everything in their power to spin the narrative to their benefit, to demonize this Tax Reform as the work of ‘evil Republicans’ who only care about ‘the rich.’ The excessive spending is causing pensions to be severely underfunded; Social Security is in trouble and wages were stagnant under President Obama. Yet the far left is doing everything it can to stop Congress from providing a direct benefit to peoples pensions and retirement.

The good news is that the left’s attempts to destroy the integrity of this Tax Reform Bill will fail when millions of Americans feel the extremely positive effects contrary to resounding false narratives – when Americans receive bigger paychecks, keep more of their hard-earned money, retirements are better funded, and more jobs become available during an economic surge – the truth will prevail, and the Fake News will only live up to their infamous term of endearment as bestowed upon by our President.

The Democrats will regret trying to block the GOP from letting American citizens potentially keep more of their hard-earned money, benefit from wage increases, protect their pensions and enjoy more financial security. Good luck with touting that accomplishment in 2018.

This Article was Co-written by Freedom Club Executive Director Alex Kharam and Freedom Club Political Director Rebecca Brannon.