On May 23, 2013 Governor Mark Dayton signed into law a $2.1 billion tax package, which added a new tax bracket with a rate of 9.85% for single residents making over $150,000, or over $250,000 for married couples. The passage of this package matches Minnesota’s history of being a high tax state, but a new report published by the Center of the American Experiment (CAE) found that Minnesota’s high taxes are producing undesirable results; Minnesotans are fleeing to lower tax states. The report finds that the state lost out on roughly $1 billion dollars in net household income between 2013-2014 alone, much of which would have been taxable.

Dayton has long been a proponent of higher taxation on high earners. As a candidate for the Governor’s office in 2010, Dayton famously stated to an audience, “read my lips, tax the rich.” Dayton even utilized a Biblical verse to drive his agenda calling for higher taxes on the rich, stating in his 2011 State of the State Address: “To whomsoever much has been given, of him shall much be required.”

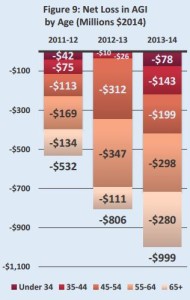

Those who are leaving are usually in their prime earning years, the CAE report found. What this means is that the state is losing out on taxable income because it has made the state unappealing for some due to high taxes. 40% of those who left 2013-2014 were between the ages of 35-54, and those between the ages 55-64 still in the workforce accounted for another 23% of the migrants. The graphic below details the net loss in adjusted gross income by age in the year 2010:

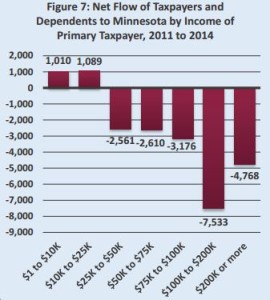

Due to the fact that the tax hike primarily affected the state’s highest earners, the CAE report found that “Minnesota loses high earning families at a much higher rate than other states.” Families earning over $200,000 per year migrate from the state at an alarming rate, in fact in 2013-2014 1.45% of families who made over the $200,000 threshold left the state. This rate was the 4th largest migration rate of similar earners of any state in the union.

Of those that are choosing to migrate to Minnesota, they predominately make less than $25,000 per year. The graphic below shows that between 2011-2014, the state lost approximately 18,549 tax payers, the majority of which made at least $75,000 per year.

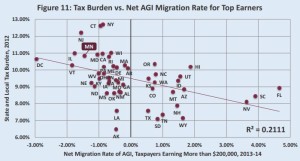

In this 21st century era that is characterized by globalized economics and competition, the report found that Minnesota’s tax policies is causing the state to lack in competitive advantage. The graphic below depicts that high tax states like Minnesota, New York, Connecticut, and Illinois are losing top earners. States with lower taxes like Florida and South Carolina on the other hand are witnessing the arrival of top earners. As top earners leave the state of Minnesota, so does their taxable income.

Despite Dayton’s claims that taxing the rich heavily would be good for the economy, the CAE concludes in its report that Minnesota should utilize its surplus to create a more taxpayer-friendly economic atmosphere to ensure that taxpayers aren’t leaving the state at alarming rates. The report concludes: “Minnesota is consistently losing the battle to attract people and income to the state. Year after year, the state on net loses thousands of people and hundreds of millions of dollars in income to migration.”

Alpha News has spoken to several organizations and business leaders on this issue, and will continue to follow up on this series. Be sure to subscribe to Alpha News to make sure you don’t miss out on future editions.